- TAO Times ⚡️

- Posts

- TAO Times #39: Spotting Subnet Scams

TAO Times #39: Spotting Subnet Scams

xTAO is live, Chutes update, & subnet fundraising

TAO Times #39

TLDR;

xTAO DAT launch: Fresh TSX listing raised $22.8 M at $1/share; founders face a six‑year lock‑up, signalling long‑term, transparency‑first accumulation of TAO.

Author’s take: Power‑law effects mean one “winner” per asset class—xTAO looks poised to be TAO’s MSTR, while rival TAO treasuries appear second‑rate.

Burntensor tool: New dashboard flags 32 subnets that burn 100 % of miner emissions; active subnets doing this are “guilty until proven innocent.”

Subnet highlights: Ridges (SN62) agents; Tensorplex (SN52) ships Interface‑Coder‑7B & dTAO bot; Chutes (SN64) adds “jobs” + startup compute credits; TaoFi (SN10) offers $10 k/day LP rewards; Yanez (SN54) closes $900 k seed—plus progress from Data Universe, 404gen, Templar, PTN/Glitch, Bitcast.

Action items: Track TAO treasuries via taotreasuries.app/@taotreasuries and use Burntensor to steer clear of inactive or extractive subnets.

Highlights of the Week

⚡️xTAO, a publicly traded digital asset treasury (DAT) vehicle focused on acquiring TAO, launched this week on the TSX. xTAO, founded by Karia Samaroo, former CEO and founder of WonderFi, raised $22.8 million from VC firms, including Digital Currency Group, Animoca Brands and FalconX.

Contrary to the popular method of raising money for a DAT, where a founding team take’s over an existing publicly listed company and dilutes holders through equity issuance, xTAO was a fresh listing, financed through a single round raising approximately $22.78 million USD at $1.00 per share.

Additionally, in a move practically unheard of until the xTAO deal, the founding team members and former shell shareholders are subject to a six-year lockup to emphasize long-term alignment. Karia and the team are focusing on transparency by avoiding the opaque structures common across the existing ecosystem of DATs, and have the objective of adding TAO per share through various creative ways.

My Take: I’m very excited to see this particular DAT hit the market and come forward with a transparency-first demeanor. Investing in these company has been particularly challenging for retail investors as there are several insider backdoor deals that prop up the companies premium to NAV alongside convoluted vesting schedules for early backers.

For the most part though, I think the trade is cooked. However, adding some side notes to this tweet of mine, I believe that power laws apply to the top pure-play DAT for each respective ecosystem (MSTR for BTC, SBET/BMNR for ETH, HYPD for HYPE, & so forth).

What is the driving force that makes that specific DAT the winner is probably a combination of raw capital distributed + mindshare and founder evangelism. At this moment, I am highly skeptical of the other DAT players within TAO, and believe that xTAO has the best chance of being the winner.

Take Action: If you are wanting to learn more about these treasury vehicles, specifically in TAO, then you should definitely visit taotreasuries.app, follow @taotreasuries on Twitter, and subscribe to their Substack. This account is on the ball.

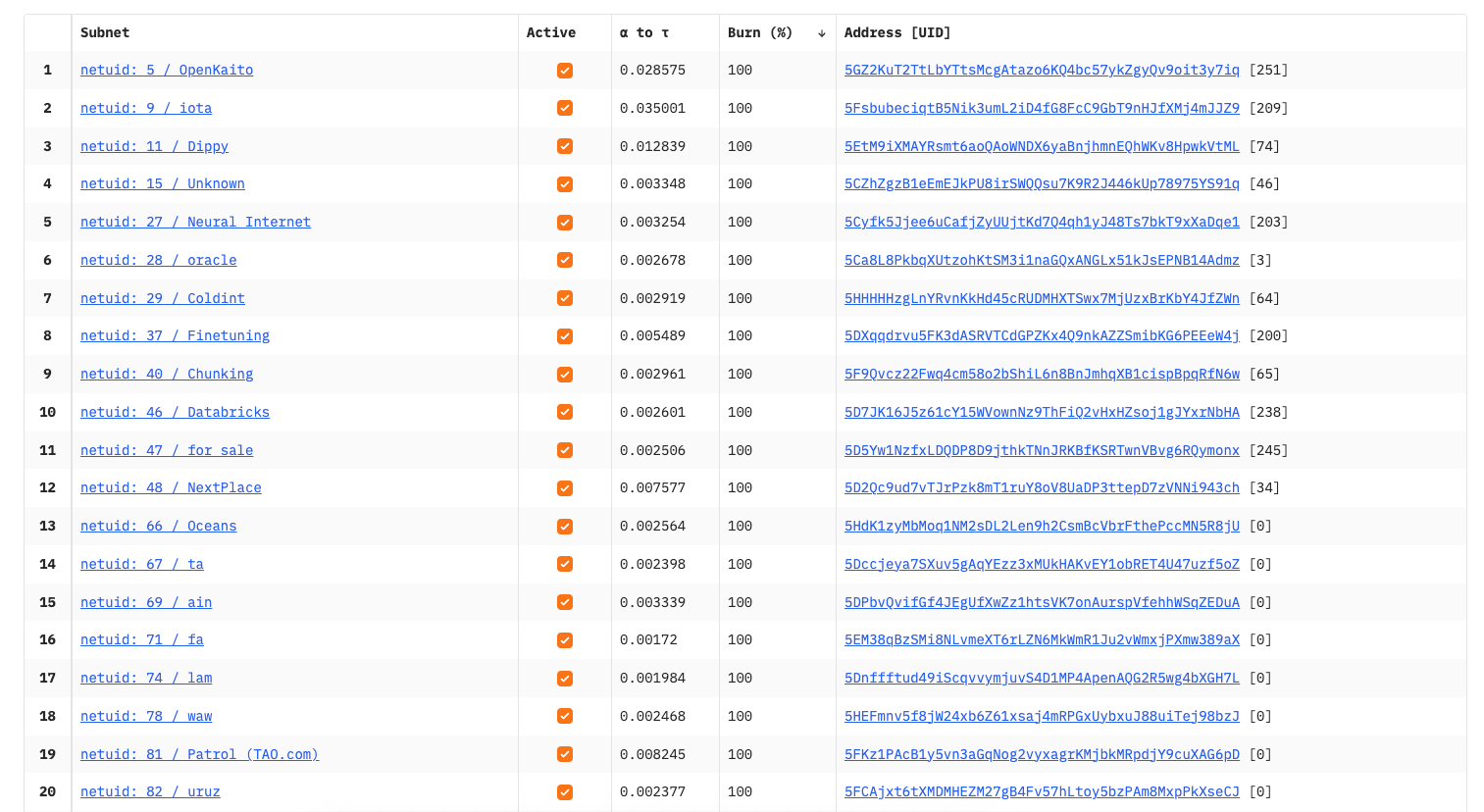

⚡️ Spotting blatant subnet scams has become much easier thanks to PawKanerak’s new tool: Burntensor… Okay I might be exaggerating a bit, not all of these are “scams” per say, just underdevelopment. But regardless, you deserve to know which subnets are inactive and underdevelopment so that you don’t mistakenly allocate your TAO to something you otherwise think is in production.

Thanks to PawKanerak, you can now easily check which subnets are burning 100% of their miner emissions, and they will soon add a column that shows the subnet backers and the $ amount of USD /day the subnets are earning. Stay diligent.

My Take: Best to steer clear of anything burning between 80-100% of emissions, and as Templar puts it:

Subnets with < 100% miner emission burn are innocent until proven guilty; they are to be evaluated on a case by case basis and usually fine.

Subnets with 100% miner emission burn and inactive are also often fine, many are just new subnets that have chosen not to turn on emissions, yet- playing by the book.

BUT Subnets with 100% miner emissions and ACTIVE are GUILTY until proven innocent in my books. This means that ONLY the SUBNET OWNER and validators + their stakers are getting emissions. So the subnet is likely NOT producing anything of value as it's not paying miners.

Scammy subnet owners will do this when they're not doing any work and trying to extract as much as they can from foolish stakers.

There are 32 of these!